The debt to equity ratio is the ratio of shareholders’ equity to debt used to finance the company those shares are for. It’s a relatively complex concept, but it is central to understanding how to value companies and shares and to understanding how businesses are financed. To understand this better though, we need to understand precisely what the term ‘equity’ means.

Essentially equity is the value of a company when put on paper. That is the net money that the company owns made up of things like – how much money the company put in originally, and how much profit it holds currently which it has not yet paid out to the owners as dividends. This does not include assets, and it does not include and various other things are also excluded such as ‘accounts receivable’ (the amount of money customers owe to the company). Essentially this means that the equity is the net value of the company, and it is what you own when you buy a share. One way to calculate the equity of a company then should be the value of the share, times the number of share holders. There are various kinds of equity, but for now this will do. In most cases the market price of the equity will be higher than the balance sheet value, because the share holder owns not only current value but also future profits – and the intention of any company is to increase profits. However in some cases the market value will be lower – when for whatever reason investors believe the value will decrease due to poor management or extraneous circumstances.

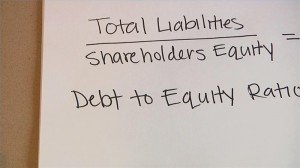

The debt to equity ratio then measures this equity against a company’s liabilities. Liabilities is essentially a term for debt but encompasses other things as well – anything where a future expense is anticipated. Debt is a liability because the company will eventually need to pay this back. However there are other costs – for instance in the case of a bank any money that a customer has deposited will count as a liability as the bank will have to pay interest on this.

Because liability and debt have to be paid before the owners of a company (the share holders) this then means that more debt decreases the value of shares. Every time a company takes out loans, this essentially means they are paying those creditors out of their pool before the share holders, and that therefore dilutes the value of those shares. The healthiest companies will have a good debt to equity ratio, meaning that the equity is worth much more than the debt.

Debt to equity ratio then means looking at the equity of a company – the value of all its shares – and the value of all the company’s debt – and then seeing how much each is used to finance the company. In healthier companies of course the

So this is what debt to equity ratio means. I have heard about it on TV. But I did not have any clue about what it means.

I understand that the equity is basically the value of a company. Good to know, thankies!

I have a home equity loan so I understand some to the things discussed here. But others are just over my head. It is no wonder why so many people feel dumb talking to bankers. It is hard to keep up with all the terms.

Never knew what debt to equity ratio means. Now I do, thanks to your site! Same with liabilities.

I can find very useful information around here. You guys do a great job.

I really don’t get this debt to equity ratio thing. It seems too complicated to me. Maybe because I am not into economy and stuff. I will look for a video on this topic, debt to equity ratio. Hopefully I will understand it, as now I am extremely tired.

Debt to equity ratio is what some shareholders are not aware of. I am serious about this. I might not be that much into economy, but I know that there are entrepreneurs and shareholders that really do not take account of the debt to equity ratio. Which is too bad.

Hmm, I think your article about debt to equity ratio is not complete. The final sentence is not finished. Make sure you are aware of that.

/ontopic: I did not know about what debt to equity ratio means, but I am glad I found out from your blog. This is a great, place, you know?